S2, Episode 8: Talking Collections with FTA's Charlie Helms,

Virginia's Chiquita Hills, and Wisconsin's Kyle Duerstein

In this episode of Tax Breaks FTA's Director of Regional Sections and Compliance Charlie Helms discusses...

Watch the video podcast Listen to the audio podcast

Watch the video podcast Listen to the audio podcast

LinkedIn Career Opportunities Feed

Discover LinkedIn career opportunity posted by Departments

of Revenue from across the United States in one location.

Career Opportunities

View featured opportunities and careers

posted on LinkedIn, and pick from

an abundance of job opportunities

with any of 55 employers from every state.

Download the Survey

of Tax Administrators

In partnership with Ernst Young and Georgia State

University's Andrew Young School Center for State

and Local Finance

Where FTA members connect, collaborate, innovate,

and help shape the future of tax administration.

Introducing the new FTA Community

Discover your community

Discover your community

Uniformity Guides Now Available!

Motor Fuels Section | Tobacco Tax Section

Download the latest uniformity guides!

Download the Motor Fuels GuideDownload the Tobacco Guide

Download the Motor Fuels GuideDownload the Tobacco Guide

Our purpose is to improve the quality of state tax administration by providing services to state tax authorities and administrators.

Federal Funding Updates

Next Event

Jul 06 - 08 2025

Charleston Convention Center and Marriott

No event found!

Upcoming Events

Jul 06 - 08 2025

2025 SEATA (Southeastern Association of Tax Administrators) Annual Meeting

Charleston Convention Center and Marriott

Jul 27 2025 - Aug 01 2025

2025 Motor Fuel Training Class

Hyatt Regency, Green Bay, WI

Aug 08 - 09 2025

2025 August Tobacco Tax Uniformity Meeting

Crown Plaza Indianapolis

Aug 10 - 13 2025

2025 Tobacco Annual Conference

Crown Plaza Indianapolis

No event found!

Are you connected with FTA on LinkedIn?

View additional @Federation of Tax Administrators content and engage with our community further!

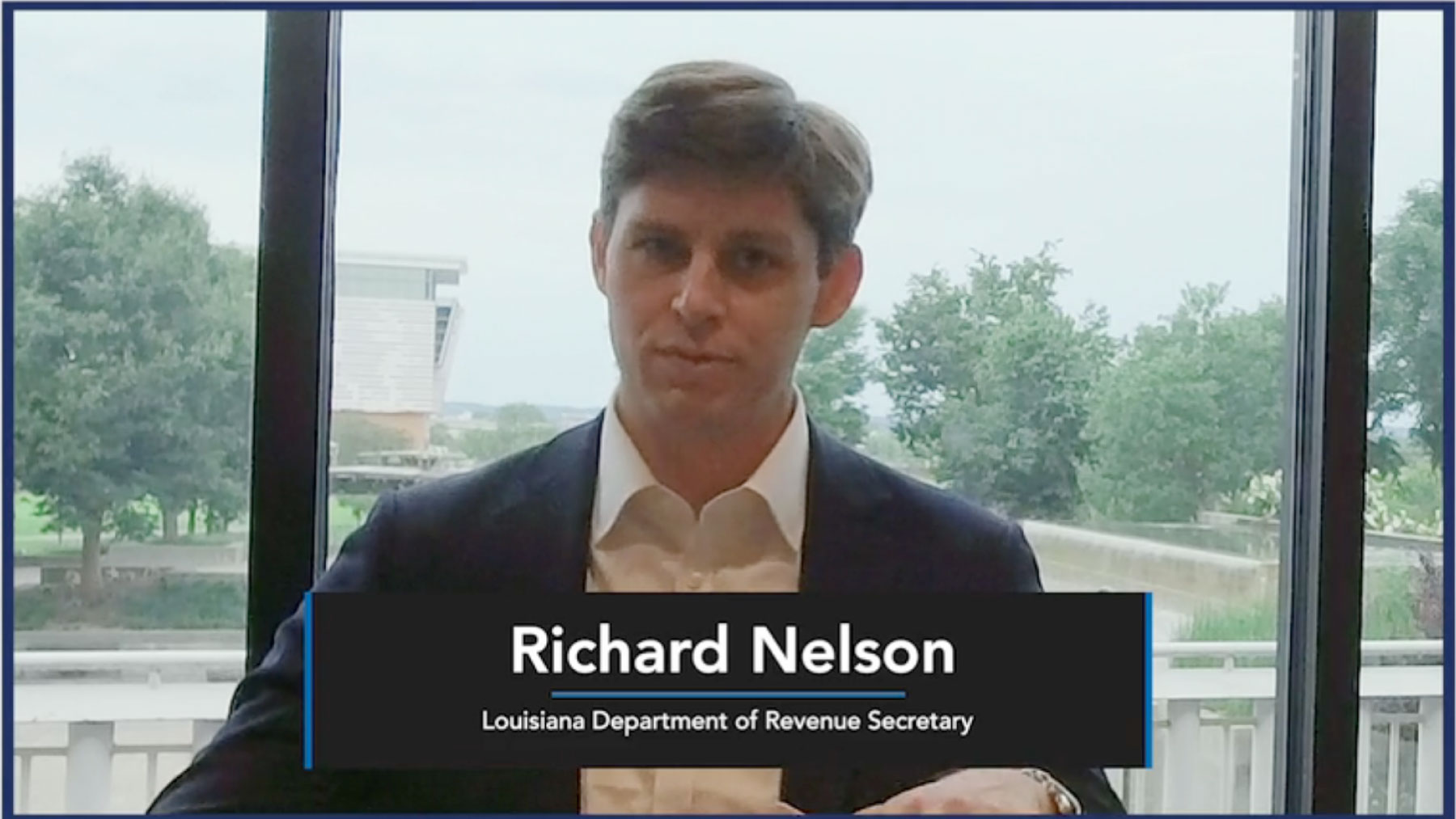

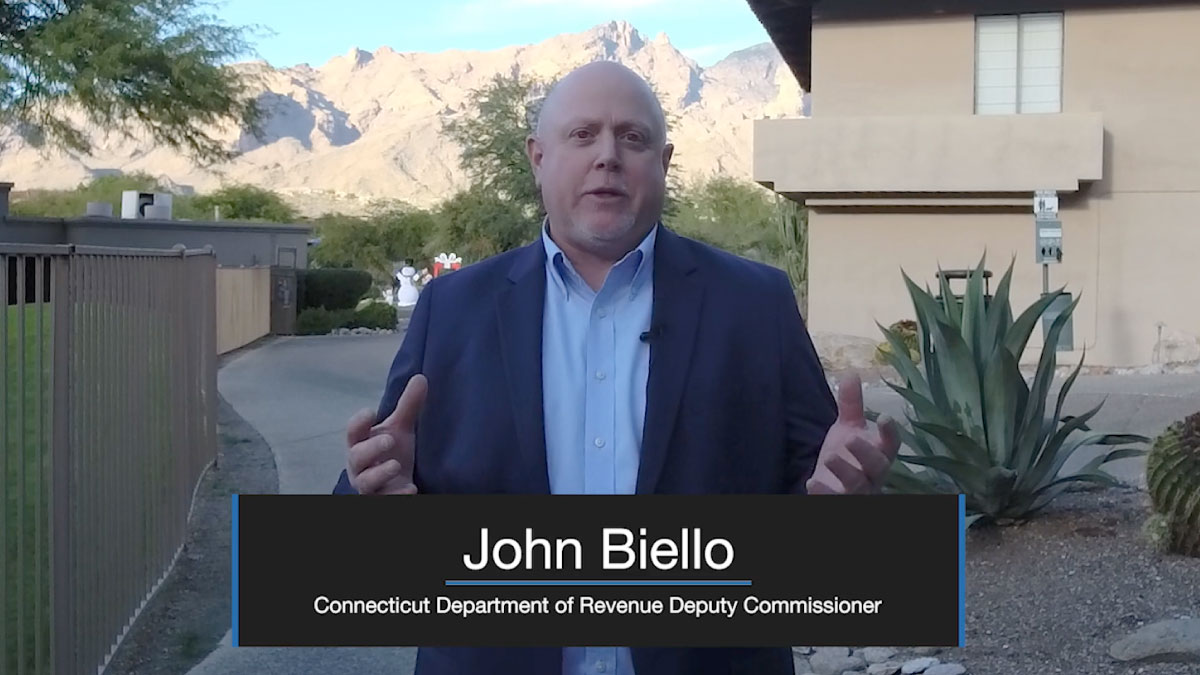

Featured Leaderboard Videos

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

FTA Leaderboard

We proudly serve the principal tax collection agencies of the 50 states, the District of Columbia, Philadelphia, and New York City.

Empowering taxpayers and preparers

Discover FTA Members

Use the interactive map below or the text-based listing to go directly to FTA Member sites.

Tax Administration Career Opportunities

View featured opportunities and careers posted on LinkedIn, and pick from an abundance of job opportunities with any of 55 employers from every state.

FTA serves as a source of information and expertise for state administrators and others on the workings of state tax agencies and systems as well as issues generally affecting tax policy and administration.